Mobile Platforms

Know about the top five fintech industry trends of 2023

Before you start your fintech app development, you need to explore fintech industry trends. Fintech apps not only provide financial products but also provide convenience to their users. The latest technology trends opened many opportunities in the financial sector, so now is the right time to invest in Fintech apps. For achieving better productivity and functionalities, technologies like Block Chain, AI, BIG data, and many more came up with the best technological innovations in fintech products.

The financial expert states that powerful technologies will shake the financial sector in 2023. Moreover, when we talk about fintech app categories, these apps offer trading, investment, financial management, and many more. The fintech market in the current time is skyrocketing and the financial giants are investing huge amounts in the latest trends of fintech. The fintech market is estimated at $698.48 billion by 2030.

The security of consumer data is more concerning when it comes to fintech apps. According to the reports in the USA 50% of banks and the rest 50% of credit unions believe that fintech partnerships are necessary. Moreover, fintech apps are helping to facilitate the growth of the finance industry.

In this blog, we shall be discussing the fintech industry overview and what are fintech apps, and the latest trends in the fintech industry.

Let’s go!!

Fintech industry overview

Let’s look at some Fintech industry statistics:

- There are approximately 30,000 fintech start-ups.

- The global financial sector is expected to be worth US$26.5 trillion in 2022, with a CAGR of 6%.

- The largest fintech company is Visa with a valuation of almost half a trillion USD.

An estimated 70% of Americans used some form of digital banking. This figure has increased year-over-year by at least 0.5%. Approximately 65.3% of the US population uses digital banking at present time.

What is fintech?

Simply, fintech is a combination of financial technology that gives leverage to technology that improves the working of financial operations and services. From mobile banking to trading applications, Fintech offers a wide range of applications and solutions.

Moreover, the fintech industry is evolving with the latest current trends in financial industry to meet customers, and business goals and improve automated delivery and use of financial services. The Fintech sector is more focused on consumer-oriented services. It includes different sectors such as retail banking, finance, fundraising and non-profit, and investment management.

Let’s look at some types of fintech app

|

Mobile banking app |

Mobile banking is the central focus of many financial technology companies. Moreover, mobile banking provides easy access to consumers’ bank accounts on their mobile devices. |

|

Cryptocurrency fintech app |

Blockchain technology has simplified the trading of Cryptocurrency. Plus, several fintech companies use blockchain technology for secure payment processing and money transfer. |

|

Payment fintech app |

You can easily transfer money with the help of payment apps. Moreover, the fintech industry growth rate is increased after fintech companies launched payment apps like PayPal and Venmo. It’s easy to send money digitally anywhere in the world with payment fintech apps. |

|

Fintech lending app |

Now applying for a loan is made easy with the help of fintech lending apps. Consumers can easily apply for a loan with their mobile phones. In addition, consumers can request multiple credit reports and make the lending world transparent for everyone. |

|

Insurance fintech app |

Several fintech companies partnering with traditional companies to help in simplifying the insurance process. |

Fintech a growing industry, you are convinced with that statement by going through the market stats. So now, is the right time to launch your fintech app in the market. In the next section, we shall be discussing the top five fintech industry trends of 2023.

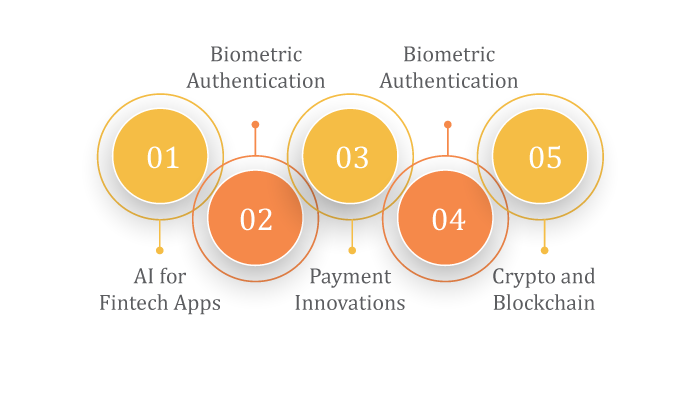

Know about the top five fintech industry trends of 2023

There are several latest trends in the fintech industry, you can easily choose any of them and launch a fintech app in the market. Chime for mobile banking and Robinhood for investing both are the best fintech apps in the market. There are a lot of FinTech Apps in the market. If you have decided to build your FinTech app this is the best time to do so. You can hire android banking app development if you want to build an app for android users.

Here are the top five fintech industry trends of 2023 mentioned below.

- AI for fintech apps

The latest trend in the fintech industry is AI. It helps them in managing user income and spending limits on a variety of things. Moreover, AI chatbots are a popular choice among fintech start-ups and enterprises. They help with payment history, and account balance,& offer personal financial advice to the user. Banking apps provide customized financial advice for assisting users to reach their financial goals which are possible with the help of AI. They help users to assist 24/7 and respond to users in real-time without skipping one.

- Easily detect fraud and block user request

- Improved security and UX

- Save time and cost

- Automated customer support

- Helpful in market research and prediction

- Biometric authentication

Fintech apps are sensitive when it comes to privacy, biometric authentication is best to enhance security. This technology helps in identifying the person and avoiding theft with biometric authentication.

- A reliable method of verification

- Lower risk and high security

- Preventing theft, fraud, and mishap

- Enable fingerprint and face recognition

It is handy and easy to use. It comes with two-factor authentication and is helpful to verify the transaction. Biometric authentication is used widely; if you include the latest technology in your fintech app the fintech app development cost will get affected by it.

- Payment innovations

A Fintech innovation includes mobile wallets, smart speakers, and contactless payment. With innovations, clients can easily make transactions securely. Multiple payment options are quicker and more convenient than accepting checks. And overseas visitors can make the purchase very comfortably.

- Crypto and blockchain

Many Fintech app builder use blockchain technology for crypto trading apps. As it is an emerging technology with advanced functionalities that makes the system secure. It is ruling over the fintech industry because blockchain solutions will reach $11.7 billion globally.

Usually, blockchain helps to integrate secure payment gateways, manage settlements, clearance and identity management, and many more. Blockchain is challenging to use on the other hand popular fintech applications contain blockchain transactions.

- Robotic Process Automation and big data

The most useful RPA is valued in the finance industry for a long time. It enables financial institutions and banks to provide the best customer service. The best fintech app developers provide RPA technology for fintech digital solutions. Big data technology has helped banks to suggest relevant products to the Fintech app development to the customer.

Conclusion

Organizations are looking forward to adapting the fintech apps because they provide amazing services in the finance industry. Many developers find it complex to develop banking apps because they require a strong security system. Therefore, the cost of developing fintech apps depends on several factors including the developers’ location to the advanced tools and features. But before you start the fintech app development, we suggest you to consult with fintech app development services you’ll get the idea related to the cost and everything.