Tech News

Steve Jobs Biopic & Other Top Tech Movie Classics

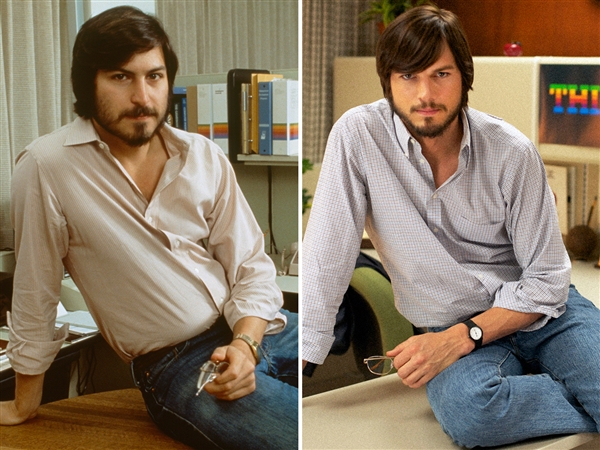

Ashton Kutcher as Steve Jobs in ‘Jobs.’ Photo by Glen Wilson, courtesy Sundance Institute and Open Road Films.

It’s too early to tell whether the new Steve Jobs biopic starring Ashton Kutcher will join the canon of top technology movies; it opens today, so I haven’t seen it yet. However, you can join me in watching the Jobs trailer, which is embedded below. The movie’s very busy website is here.

I do know that the film’s release gives me a good excuse to take a breather from our usual Friday post of Oracle-related links and bring you instead my top 10 list of tech-related films you’re not going to see on anybody else’s roundup. If you’ve followed my blogging, you know this means they’ll be somewhat obscure, somehow elitist, but all eminently watchable. That’s if you can find them; I’ll include Netflix and Amazon Prime availability, and not just because it gives me an excuse to play with the big screen while I’m writing this post.

The upshot is that my list contains only one of the usual suspects. There’s no Tron, no Back to the Future, and certainly no Star Wars (not a fan). As for Star Trek, I’m a child of the Shatner/Nimoy era, and enjoy those movies, but you don’t need me to point you to them. (FYI, David Ellison, the son of Oracle’s CEO, is executive producer of the series’ latest iteration, Star Trek Into Darkness.)

As for ‘Jobs,’ Kutcher has an advantage in that he certainly looks the part. In real life, according to a recent interview he did with The New York Times, he has tech cred because he’s “An Actor Who Knows Startups.” He’s invested in several social and mobile ventures, and he told the paper: “I look for companies that solve problems in intelligent and friction-free ways and break boundaries.”

I’m familiar with Kutcher only in passing—as in, I used to pass by the TV set when my daughter was watching That ’70s Show. The sitcom, which ran for nine seasons beginning in 1998, seems to view the decade of Watergate and disco through the prism of a basement bong. It may be a trite truism that those who lived through the 1960s don’t remember the decade. However, I rarely joined my daughter, because those of us who actually grew up in the 1970s would prefer to forget them.

OK, so here’s the official Jobs movie trailer, courtesy Open Road Films:

Now it’s onto my list of great tech movies, in no particular order.

What’s the original big data movie? In my estimation, that’d be The Andromeda Strain. The 1971 film version of Michael Crichton’s book revolves around an extraterrestrial virus that finds itself in a small town in Arizona. It wipes out everyone, except for one old man and a baby. (But enough about Steve Guttenberg’s career.) A tiger team of scientists is dispatched to contain the disease, lest it spread to Hollywood and beyond. I detected the big data meme in an early scene where scientist Ruth Leavitt, played by the late Kate Reid, stares at a computer terminal to assess some molecule or other.

Lots of movies seem to portray tough technical problems as being amenable to solutions if someone simply peers really intently at a screen for prolonged periods of time. Those of us who’ve done precisely that know we’re more likely waiting for a slow page to finish loading.

I hope I’m not breaking the spoiler-alert rule if I tell you that the story’s denouement involves another theatrical construct that likewise doesn’t translate well into the real world. Namely, a nuclear device blows the virus, and the rather large research facility that proves unable to contain it, to bits.

Nuclear obliteration is also used to wrap up the plot of the noir classic Kiss Me Deadly. The downscale 1955 drama—Ralph Meeker plays déclassé private detective Mike Hammer—is often the next viewing step up for budding cineastes who’ve previously become enamored of Bob Le Flambeur. Like many contemporaneous movies, Kiss Me Deadly is infused with the Cold War mentality that screams it’s all about to end badly. And it does, via what I call “bad tech in a box.” Respinning a plot device that goes back to Lot and the Bible, someone can’t resist opening a container of unspecified provenance lurking in the corner. You know, the one they were told to stay away from. (An inability to keep the lid is also part of a pivotal scene in the 1999 romp, The Mummy.) You can guess what happens next, right before the credits roll.

Sometimes it’s a person who blows his top, psychologically speaking. That’s what happens to the laid-off defense engineer ably played by Michael Douglas in 1993’s Falling Down. I’ve long felt that this film has been underrated. I’ve secondarily attributed this to the fact that 20 years ago, Michael Douglas wasn’t the critics’ darling he is today.

But mostly, I believe it’s because of the way his character presents. William “D-Fens” Foster—he’s a defense engineer, get it?—wears a short-sleeved white shirt, horn-rimmed glasses, and a pocket protector. He’s so geekified that most audience members can’t relate to him, and those who can don’t want to be reminded of it. But the slow burn of the plot, the cinematography of a spent and sprawling Los Angeles, and the barely repressed rage expressed via Douglas’s performance combine to create a feeling that there’s a real character beneath the engineer-gone-postal plot. Supporting actress props to the always reliable Barbara Hershey as Foster’s ex-wife.

source: http://www.forbes.com/sites/oracle/2013/08/16/steve-jobs-biopic-top-10-tech-movie-classics/